Dental care is expensive. From braces and implants to dentures and even routine care, going to the dentist requires a large investment, despite the social security system. Whether you want to give your children the best dental treatment or simply control your expenses, it's time to find a good dental insurance plan that can meet your needs and cover the full cost of dental care.

Here is our commitment, to make sure that we provide the best user experience and content quality:

You can support us by using our links to make your purchases (at no extra cost to you)! This sometimes earns us a commission which allows us to remain independent. More about us

Our selection

"Apicil offers the best guarantees on dental care through the My Profil'R Particuliers Dynamique offer. It applies the 100% health plan on some of its…"

"The dental reimbursements of the Miltis mutual insurance company are around 194 euros depending on the contract subscribed. This mutual insurance company promises a more…"

"The Smatis Optimum plan covers 400% of dental expenses. There are no remaining costs for dental prostheses and beneficiaries obtain better conditions from partner practitioners…"

"Efficient reimbursement rates are offered to seniors through Apivia Vitamin benefits. This can be as high as 350% and the benefits on dental care increase…"

Apicil offers the best guarantees on dental care through the My Profil'R Particuliers Dynamique offer. It applies the 100% health plan on some of its benefits. This offer covers the care not reimbursed by the Social Security.

See the priceThe My Profil'R offer proposed by Apicil is available in 4 reimbursement levels. Choose the rate that suits your budget. For dental crowns, the reimbursement rate varies from 100 to 450% for a contribution that goes from 21.98 euros to 103.68 euros per month. Apicil stands out for its excellent quality/price ratio. Its offers are suitable for all individuals, whatever their profile. A family of 4 members (couple + 2 children) will benefit from it as well as young people in their twenties.

The dental reimbursements of the Miltis mutual insurance company are around 194 euros depending on the contract subscribed. This mutual insurance company promises a more complete coverage on current, surgical and specific care.

See the offerWith the Luminéis offer, Miltis reimbursements are reinforced at the dental level. It implements a 100% health care basket to reduce your out-of-pocket expenses. Dental care and Inlay-Core are reimbursed up to 150% on this contract, and prostheses and orthodontic treatments up to 300%. This offer includes care not reimbursed by the health insurance system in its benefits, including a reimbursement of up to 400 euros for dentures, crowns, implants and periodontics.

The Smatis Optimum plan covers 400% of dental expenses. There are no remaining costs for dental prostheses and beneficiaries obtain better conditions from partner practitioners and service providers.

See the offerSmatis offers an annual ceiling of 2,000 euros on annual dental care. This limit increases as the beneficiary renews the contract. For this purpose, this ceiling is valued at 2,500 euros per year at the beginning of the third year of subscription. In particular, the maximum reimbursement for implantology, periodontology and orthodontics is 600 euros per tooth with this organization. Ask for a quote to get a personalized offer according to your consumption level and the number of people covered.

Efficient reimbursement rates are offered to seniors through Apivia Vitamin benefits. This can be as high as 350% and the benefits on dental care increase with the level of coverage chosen.

See the offerWith the Apivia mutual insurance company, dental care for the elderly can be reimbursed on a flat-rate basis or as a percentage, depending on the supply and demand of clients. The purchase of equipment that is not covered by the Social Security is compensated by the Vitamin contract. For implants, prostheses and routine care, the reimbursement is around 500 euros per year. As for orthodontic care, it is covered with a percentage of 100% more compared to the base of the Sécu.

Any specific needs?

The best dental mutual in 2021

The best entry-level dental mutual

The best premium dental mutual

The best dental mutual for seniors

Your guide :

Rate this buying guide :By rating this buying guide, you are helping us to reward our best writers. Thank you!

| TOP OF THE LINE | CHEAP | TOP OF THE LINE | EXCELLENT | |

In accordance with our commitment, this buying guide does not contain any sponsored products. |

8/10 |

8/10 |

9/10 |

8/10 |

| OUR SELECTION |

Apicil - My Profil'R

|

Miltis - Luminéis

|

Smatis - Optimum

|

Apivia - Vitamin

|

|

Apicil offers the best guarantees on dental care through the My Profil'R Particuliers Dynamique offer. It applies the 100% health plan on some of its benefits. This offer covers the care not reimbursed by the Social Security.

|

The dental reimbursements of the Miltis mutual insurance company are around 194 euros depending on the contract subscribed. This mutual insurance company promises a more complete coverage on current, surgical and specific care.

|

The Smatis Optimum plan covers 400% of dental expenses. There are no remaining costs for dental prostheses and beneficiaries obtain better conditions from partner practitioners and service providers.

|

Efficient reimbursement rates are offered to seniors through Apivia Vitamin benefits. This can be as high as 350% and the benefits on dental care increase with the level of coverage chosen.

|

|

|

|

100% health care and prostheses

|

100% Health Care Basket

|

Increased annual cap starting in the third year

|

Partnership with Santéclair

|

|

|

Free baskets

|

Reimbursement rates up to 300%

|

Competitive offer for seniors

|

Very advantageous optional reinforcements

|

|

|

Implant package

|

Reimbursement for sophisticated equipment

|

Quote online or by phone

|

Flexible contract

|

Help us improve this table:

Report an error, request the addition of a feature to the table, or suggest another product. Thank you for your kindness!

We spend thousands of hours each year studying the major specialized websites, analyzing products of hundreds of brands and reading user feedback to advise you on the best products.

We are a product review company with a single mission: to simplify your buying decisions. Our research and testing helps millions of people every year find the best products for their personal needs and budget.

To support us you can: use our links to make your purchases (which often earns us a small commission), share our articles on social networks, or recommend our site on your blog. Thanks in advance for your support!

Before looking for a mutual insurance company, define your profile first. It is evaluated according to your age. The needs are not the same for a young person as for an elderly person. The adapted offers then vary according to your previous dental health problems. They influence your current and future needs. From there, you will be able to set up your budget depending on the expenses to be expected. This way, there is no risk of paying more than you can afford. Then, you will have no trouble analyzing the quotes offered on the mutual insurance companies' websites.

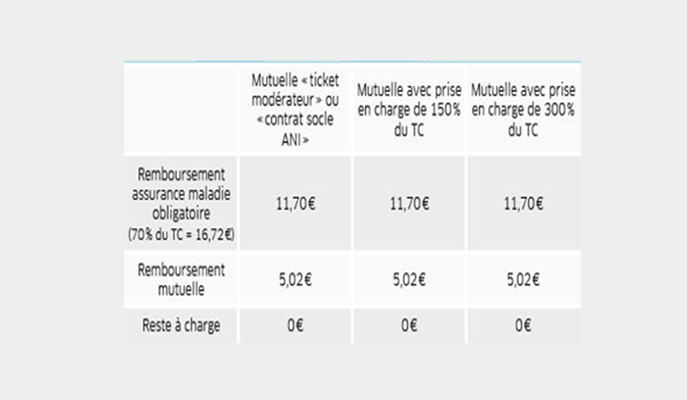

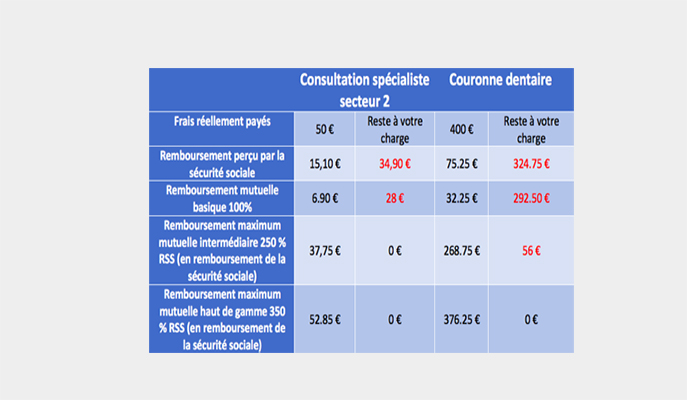

Once your needs are clear, you will be able to go ahead and check if the reimbursement rates presented are suitable for you. Insofar as you are looking for a family mutual, the needs of all the beneficiaries are taken into account. The objective is to finance regular treatment and follow-up with a specialist for all beneficiaries. You can choose either a percentage reimbursement rate or an annual flat rate. Percentage reimbursement is not always sufficient if you need care more often than average. Even 100% coverage can leave you with a considerable out-of-pocket expense if you choose poorly, especially when you plan to have expensive operations or major equipment replacements. Conversely, the annual package can cost you a lot of money if you have fairly good dental health.

An offer with a 100% health basket is more advantageous. This means that your out-of-pocket expenses have been reduced or even eliminated in some cases. Even if your mutual insurance company applies this plan, be aware that not all benefits are covered. For instruments, the purchase of bridges, crowns and prostheses are among the privileged benefits. You will not be able to benefit from this if your main needs are related to implants.

The

benefits are different for all mutual insurance companies. It is up to you to see if the benefits offered by the mutual insurance company you are interested in fit your needs. If so, are the reimbursement levels compatible with your expectations? On this subject, note that the cost of orthodontics and dentures is relatively astronomical. Look for specific plans that offer maximum benefits for these treatments, as prices are not always known in advance for these treatments. Other services are not a problem. For example, most mutual insurance companies reimburse the full cost of routine care. This is part of the basic package.

Most mutual insurance companies set a ceiling on the reimbursement of excess fees. It is presented for a period of one year and changes regularly. It is a percentage of the Social Security rate. Mutual insurance companies without a ceiling are more expensive. However, they are also a must for some members, such as those who schedule orthodontic treatments or those who will need implants. Although, this option is more recommended for seniors. The reimbursement rate for these benefits is actually between 600% and 800%.

Dental insurance companies specialize in reimbursing dental care. It is normal that the offers are broader with these organizations. They try to adapt the benefits to the specific needs of each consumer.

As you can see, the dental mutual insurance is in addition to the reimbursement rate of the Sécu, especially for surgical and orthodontic care. As a reminder, the Health Insurance only honors the reimbursement of routine and conservative care such as preventive visits or caries treatment.

With a mutual insurance company, you have the possibility of having reimbursements without a ceiling that are more appropriate to the real costs of dental care. The subscription to a dental mutual insurance is made with the aim of reducing the remaining expenses by means of stronger guarantees, sufficient to pay for the extra fees.

Adults are more in need of a mutual insurance than children, as the latter's expenses are more or less covered by the Social Security contribution. Mutual insurance companies provide their clients with a network of health care services that allow them to benefit from better services even for treatment abroad.

The dental insurance companies on the market are divided into two categories according to their pricing method.

Mutual insurance companies with tariff reimbursements offer coverage with amounts determined in advance. You will therefore know exactly how much your mutual insurance company will pay for a particular treatment. If you have not used a part of this benefit, the corresponding amount is carried over to the following year. Subscribers who do not often have a dental problem will benefit from this system. Conversely, you may have to make up the missing amount if the cost of care exceeds the stated package.

With

percentage coverage, the reimbursement is based on the rates proposed by the Sécu. Some mutual insurance companies offer 100% reimbursement, while others go up to 800%. The offers are very mixed. The higher the percentage, the higher the premiums. But the benefits increase at the same time.

The dental mutual insurance focuses more on dental care, which is not the service most emphasized by the Social Security. It comes to compensate for the hole left by the latter with varied, enriched offers adapted to all budgets.

Health insurance reimburses only a small part of dental care, 70% to be precise. The rest is still a huge expense. It is far from being sufficient to support all the related expenses.

Health insurance will never replace the dental mutual insurance. If you want to get rid of expensive dental expenses, it is recommended, or even mandatory, to use a complementary health insurance.

Choose annual packages

Annual lump sum reimbursements are more advantageous. Thanks to this method of reimbursement, your unused benefits are carried over to the next year.

Benefits do not have the same conditions

Since

the reimbursement rates and the conditions of coverage are never the same for all mutual insurance companies, it is up to you to check whether the proposals made to you are consistent with your situation

.

Choose an organization that does not apply a waiting period

Sign up

with a mutual insurance company that makes all its services available to you after signing the contract.

Differentiate between the available care baskets

With regard to

a dental mutual insurance, 3 baskets of care are proposed including the 100% Health basket presented above, the basket with controlled rates which is linked to mutual insurance companies with a ceiling, and the basket with free rates which apply to high-end and more expensive equipment

.

A reputable mutual insurance company is not always interesting

It is

not that a mutual insurance company is very well known that its offers are necessarily the most attractive. Good coverage can just as easily be found with organizations that have recently joined the market. You should always compare quotes.

The best dental insurance depends on your needs and your budget. Read our buying guide to find out which products are the best.

The Assurance Maladie only reimburses 70% of the Sécu base. Thus, the most important care and whose rates are exorbitant are not taken into account.

The price of the contributions depends on the extent of the proposed guarantees and the reimbursement rates of the mutual insurance company.

Ask for a quote and a list of the coverages offered. This will give you the details of the offer.

For mutual insurance companies with a ceiling, the maximum amount covered varies between 1,500 and 1,800 euros per year for a person with a fairly high consumption.

Every month we help more than 1 000 000 people buy better and smarter.

Copyright © 2022 - Made with ♥ by buyingbetter.co.uk

Your reviews and buying guides 0% advertising, 100% independent!